Maximizing Your Dental Care and Understanding Dental Insurance

We all carry various forms of insurance generally to avoid hefty out of pocket costs. In many cases, it is a no-brainer to have certain insurance. Currently, health care law prohibits insurance companies from setting dollar limits for yearly or lifetime coverage for essential health benefits. Despite poor dental health having the ability to cause pain, infection, affect chewing and thus nutrition, implications with other serious health conditions, as well as mental health, dental benefits for adults are absurdly considered “optional”.

Annual Maximums

Because dental is not protected from the dollar limits, dental insurance companies definitely take advantage of this and in most cases set an annual maximum of $1,000-$2,000, and have not changed that amount for about five decades. For proper perspective, $1,000 in January 1973 had the same buying power as $7,022.77 in January 2023.

What does $1,000 get you in dentistry? A dental crown, even on the low end, is over $1,000 using in-office fees. Some doctors take a lower rate to be in-network with insurance, but it would still be at least several hundred dollars. Exams and cleanings are also counted towards that $1,000-$2,000. So even though you might be paying zero at those visits, the insurance company is paying something, which will reduce your remaining benefits by that amount. This means it is very possible to eat up your entire year’s “benefits” with one treatment need. That is pretty abysmal for “insurance”.

Denials, Limitations, and Exclusions

Dental insurance companies are very good at making their plans look appealing by having simple breakdowns, which usually say something like: “Diagnostic and Preventive: 100%, Basic Restorative Services: 80%, Major Restorative Services: 50%” That looks pretty good! But when you consider that they only have to provide coverage up to your annual maximum, a little less good. Add that they can deny any treatment they determine as “unnecessary”, despite the licensed dentist who actually examines you saying it is necessary, even worse.

Considering that dental benefits for adults altogether are considered “optional”, it should not surprise you that insurance companies deny coverage for procedures all too-often. Some plans do not cover treatment if it is for wear, attrition, erosion, or abrasion, even though these are dental conditions, which often require treatment.

Here are a few other denial codes: “Less expensive alternate [treatment] is professionally accepted”. “Questionable prognosis” (So why even try?) “Service denied because payment already made for same/similar procedure within set time frame” (Source: Delta Dental website), and the list goes on.

Other ways dental insurance companies avoid payments are with waiting periods, provisions for preexisting conditions, and senseless rules. Here is an example: “The Limited Oral Evaluation Benefit is payable only for visits where no other covered services are performed.” (Aflac Dental Insurance) So basically with this plan you can go in for an exam for a problem, but if you want it covered, you cannot have treatment the same day. These caveats and hoops to jump through can be incredibly disheartening for both patients and providers.

In-Network vs Out of Network and HMO vs PPO

Providers that are in-network for a plan have agreed to sign a contract with the insurance company for that plan. This means they are bound to rules and limitations by the insurance company. They agree to take a discounted fee for their services in order to be in the network. Some insurance companies refer to them as “preferred providers”, but preferred is only an indication that they have signed their contract. When providers take discounted rates, some of which are appallingly low, for their services, it is sometimes necessary to compensate in order to remain profitable or even just to avoid a loss. You may sometimes see this reflected in shorter appointment times, longer wait times, a need for a heavier volume of patients, or cheaper materials and/or labs utilized.

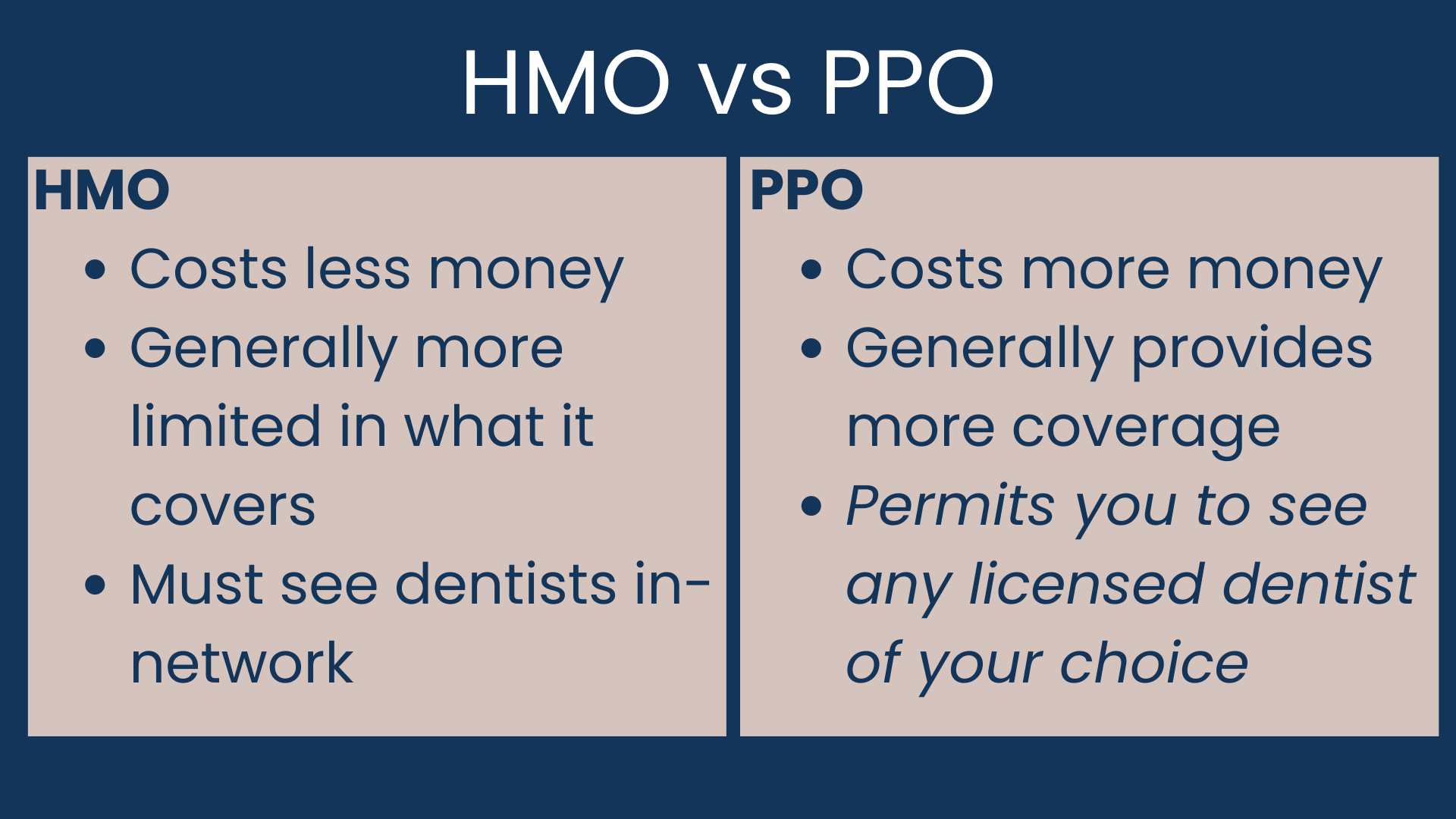

If a provider is out-of-network with your insurance plan, it does not mean you cannot see them or that you cannot use insurance benefits with them, as long as you have a PPO plan. HMO plans usually cost less money than PPO plans and require you to see in-network dentists to provide any coverage. PPO plans generally cost more, in part because they have the benefit that you can choose any dentist, and are not limited to in-network.

Being out-of-network means these are unrestricted providers for a given plan, and they are not bound and limited by insurance contracts. They are able to provide your care unhindered and without any puppeteering by insurance, and decisions are made solely between the doctor and the patient. Because unrestricted providers are able to determine a fair rate for their services and do not have to answer to insurance companies, they may have more time and resources available for patient care and experience. Some of them even offer their own in-house savings options for patients.

Key Takeaways

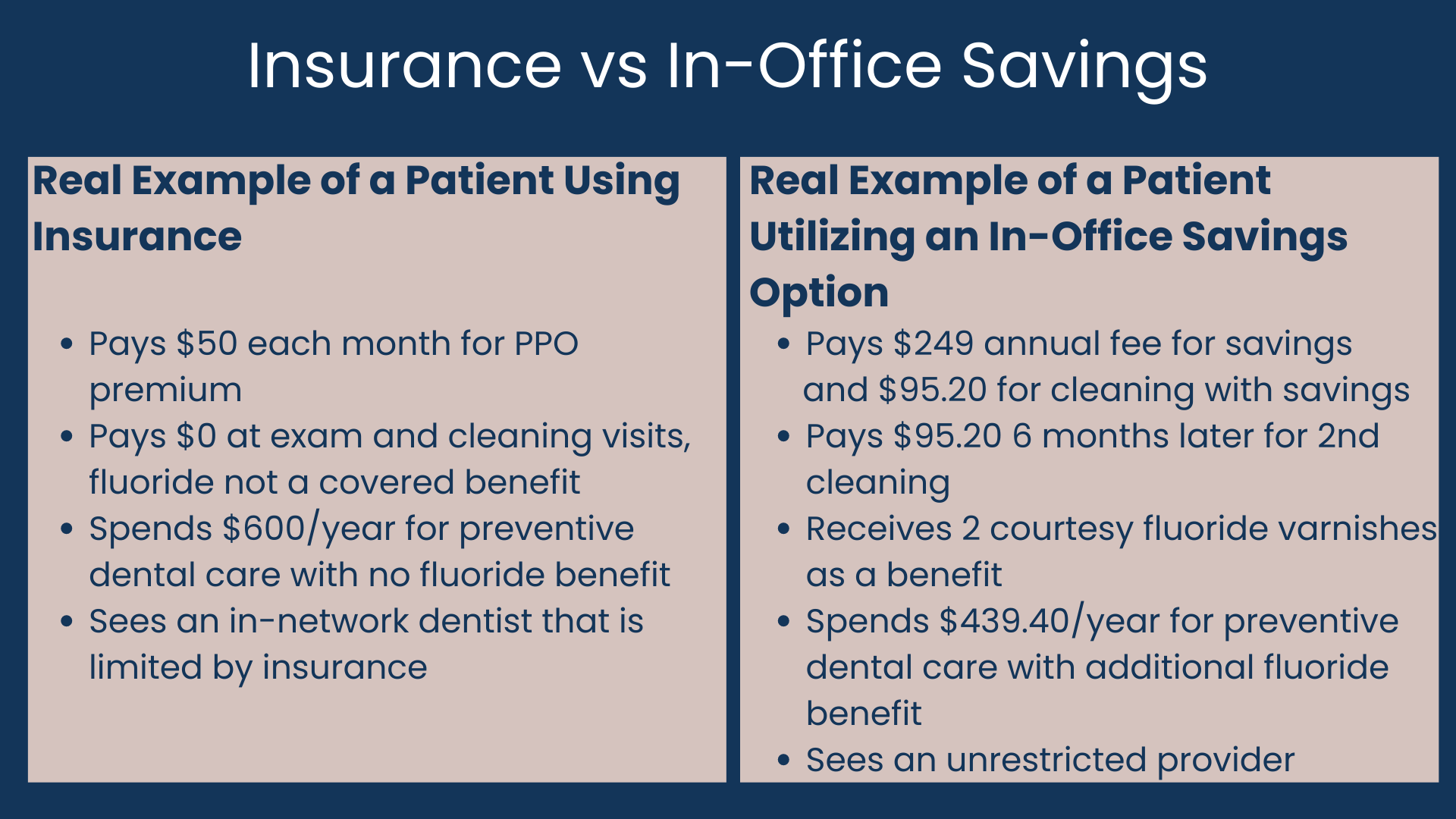

In some cases you may actually spend more on your insurance premium for the year than you would have spent out of pocket going to the dentist, particularly if you only require preventive care. Some dental offices offer their own savings options, which are definitely worth considering in place of dental insurance. Many times these options are more transparent, and you don’t have to deal with an arduous claims process with potential denials, or a third party in the middle of your care. And for most, there is no enrollment period like insurance, so you can join at any time.

If you have dental insurance, it is best to think of it more like a coupon. Use it for a little savings when it applies, but just like you generally shouldn’t use a coupon to decide where to shop or what to buy, don’t let dental insurance dictate whether or not to complete a treatment or whether or not to start or stop seeing a dentist you trust and are comfortable with. Be aware that particularly if you have more extensive treatment needs, dental insurance coverage will usually max out early into your care.

ABOUT THE AUTHOR

Dr. Kelsey B.P. Garza is a General Dentist and the owner of Darling Dentistry in Bulverde, TX. She is delighted to be able to provide patients in and around Bulverde and Spring Branch with an elevated experience to the dentist through quality, compassionate, and ethical care with special attention to providing a more relaxing environment and helping patients overcome dental anxiety and fear. She is also happy to offer an in-house savings club as a wonderful alternative option to dental insurance for her patients. Dr. Garza is an active member of the Academy of General Dentistry, American Dental Association, American Association of Women Dentists, Texas Dental Association, San Antonio District Dental Society, and the Bulverde - Spring Branch Area Chamber of Commerce. She is accepting new patients. If you have any questions or concerns or would like to schedule an appointment, click the Schedule Now button to reserve through our online scheduling, or reach out to 830.357.7177 or care@darlingdentistry.com.